What is value-add in real estate?

Value-add real estate refers to the type of property that an investor is buying or selling, one where the property’s value increases when you make improvements.

These properties offer investors the opportunity to improve an asset’s cash flow through renovations, adding amenities, rebranding, or operational efficiency, e.g., more efficient management.

Investments in value-add real estate typically target properties with an existing cash flow. However, they hope to increase that revenue stream (add value to the property) over time by improving or repositioning the property. Efforts can be increased to attract quality tenants and improve property management to reduce operating expenses and satisfy customers, or improvements can be made to the property to command higher rents. Sometimes, owners sell assets to capture value increases after increasing net operating income at their properties.

Value-Add Real Estate Model

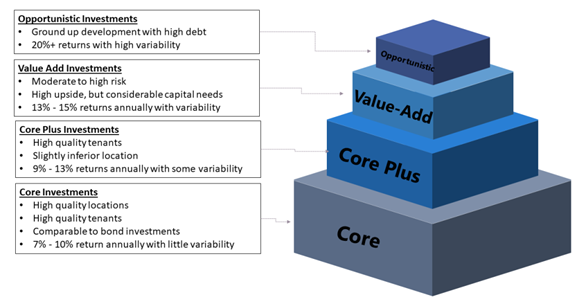

Bullpen, a company that connects commercial real estate experts and companies for on-demand work, illustrates its value-add real estate model in the following way.

While anyone can work on a value-add real estate deal, this type of investment is often of particular interest to private non-institutional investors who are willing and able to take on more risk. It is flourishing in the multifamily markets even though it has been around for years.

As a Value-add investor, your goal is to improve profits by creating untapped revenue potential or establishing value through property upgrades.

You stand to benefit from higher returns on your projects since they often are financed at medium-to-high leverage levels. Value-added investments will generate higher returns for you than core investments because as their value increases, so does your return on investment. However, these projects carry a greater risk at the time of acquisition since the properties may be only partially leased, renting at below-market rents, or have deferred maintenance.

When the previous owner’s business plan fails to maximize a property’s value, the property may be sold at a lower price than expected. As a result, value-added projects offer an ideal balance of risk and reward, generating cash flow during acquisition and providing significant upside through value appreciation over the years.

Benefits of Value-AddBenefits of Value-Add

Compared to core or core-plus properties, value-add real estate properties have a higher potential return on investment. When you find such an opportunity and are able to add value you can then sell or hold on to it with the improved cash flow.

Some examples of value-add real estate that may yield results are:

- Properties that need improvement

- Utilize more leverage (debt)

- Rely on construction and development projects to generate returns

- Making physical improvements that will allow higher rents

- Generate higher financial returns to investors than core investments due

For individual or group investors, value-add is a great way to leverage your expertise in the real estate industry to generate higher returns than projects that don’t have a value-add component.

Solid strategies in construction management add value that can be measured in terms of:

- Reduced costs and time

- Lower risk

- Higher quality

Value-Add properties may be enhanced through innovative services that may make for better projects and more creative solutions to challenges.

“Investors in value-add real estate projects also receive the benefits that come with all commercial real estate purchases, including possible appreciation and stable, long-term cash flow.” Gower Crowd.

A value-add investment may also be more dependent on total returns than shorter-term current yields because price appreciation can be an essential source of returns. When renovating vacant units or spaces in value-add deals, rents will likely decline during the construction and improvement phases.

Tax Advantages of Value-Add

According to Grower Crowd, “When engaging in new construction or renovations with borrowed funds, you can add the interest you or your company pays on the loan to the basis of your property and depreciate it over 27.5 years, under the same depreciation schedule as standard commercial property, per Internal Revenue Code Section 1.263A-1. Value-add properties are also eligible to be added to a 1031 Exchange to defer taxes on capital gains, which can allow you to reinvest your gains each year, while not having to pay Uncle Sam until you withdraw your investment”.

What is an ROI?

ROI measures the return on investment (profit you made), which shows how much you made or lost on an investment. You can also use ROI as a metric to help evaluate if you want to purchase a property. ROI, in addition to Cap Rate, can help evaluate properties on an apples-to-apples basis.

How to calculate an ROI?

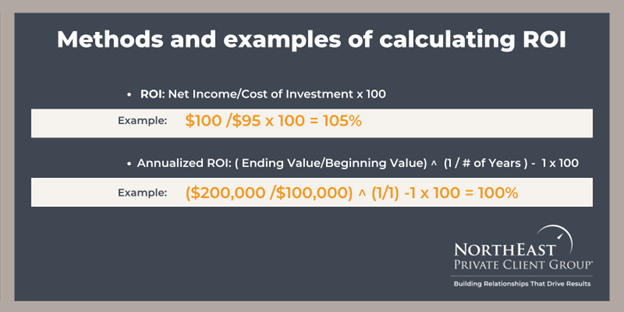

ROI is calculated by comparing the total amount you have put into the property, with the initial purchase price as well as any further costs, to its current value. To calculate a return on investment you would take the net income and divide it by the total cost of the investment or ROI + Net income / Cost of investment x 100.

Below is an example of the ROI calculation:

Net Income: $12,500/year divided by

Down Payment: $50,000 = .25

.25*100 = 25% ROI-> in four years you will get your money back

ROI is not how much money goes into the property, but it’s more about how fast the money comes out.

How Is ROI Calculated For Real Estate Investments?

Below are several ways that you can calculate ROI for real estate investments depending on the circumstances. What is important to remember is that when comparing multiple properties you should include the same line items in each calculation.

- ROI = (Investment Gain − Investment Cost) ÷ Total Investment Cost

- ROI = Net Income ÷ Total Investment

- ROI = (Annual Rental Income − Annual Operating Costs) ÷ Mortgage Value

What are the Benefits of Using ROI ratios to evaluate Investment Real Estate?

Per TechTarget the benefits of ROI ratios include the following:

- Generally easy to calculate. Few figures are needed to complete the calculation, all of which should be available in financial statements or balance sheets.

- Comparative analysis capability. Because of its widespread use and its ease of calculation, more comparisons can be made for investment returns between organizations.

- Measurement of profitability. ROI relates to net income for investments made in a specific business unit. This provides a better measure of profitability by company or team.

How does a value-add opportunity benefit your ROI?

Value-add real estate investments generate a greater return on investment than core or core-plus properties.

“Since investors are as distinctive as the properties they pursue, it is logical that their underwriting criteria for value-add opportunities also vary. Many private owners find value-add success operating purely on instinct.

Other operators take a more sophisticated approach, particularly if they have institutional capital partners. The underwriting metrics applied by these investors are remarkably consistent.

For shorter-term holding periods of three-to-five years, the value-add investors surveyed by CapasGroup Realty Advisors target a leveraged internal rate of return ranging from 16 to 20 percent. The desired return on investment for capital expenditures usually centers on 22 to 25 percent.

For instance, unit upgrades costing $6,000 per unit must generate rent premiums averaging $110 per month to satisfy a 22-percent ROI threshold. That is, $110 x 12 months = $1,320 rent premium / $6,000 investment = 22 percent return. Although return requirements and upgrade costs vary by investor and property, these concepts apply to most value-add scenarios”. CCIM Institute.

Is value-add real estate investing for you?

While value-add real estate investments are available to everyone, it takes a certain type of person to excel in this type of investment. Remember that these deals have a higher risk associated with them. It’s important to consider how you’ll add value to the asset, what timeline and resources you have in place to complete your project, and your exit strategy.

Also, ask yourself what your risk tolerance is. Value-add real estate may not be the best way to start in real estate investing, but for those with the resource and ambition investing in value-add real estate may have great results.

As properties age and market conditions change, opportunities to produce new revenue and drive value will continue. The current environment of rapid rent growth and low-interest rates has helped value-add investors. There is more risk associated with value-add in real estate investments, but some portfolios can benefit from them. With the right property, value-add real estate investments can provide outstanding returns and substantial tax advantages, boosting your ROI. As rent growth stabilizes and interest rates increase, value-add real estate success will become progressively reliant on investors’ loyalty to a strict strategic plan, market awareness, and ability to adapt.

Leave a Reply